Advantra Wealth is a venture builder focussed on FinTech based in the UK and Switzerland.

Amplify, its first venture for the wealth management industry, is now ready for a strategic acquisition. Amplify is an integrated customer driven/advisor enabled business solution built by industry-experts.

This is a unique opportunity for wealth and asset managers to launch their own digital offering.

Reduce time-to-market

De-risk the innovation journey

Own a proprietary solution

Reach out to anka@advantrawealth.com to get the teaser deck.

Total wealth control

Wealth management is on the cusp of digital disruption. Advantra is a huge leap forward. It is a single platform that puts high net worth individuals and banks in full control of their wealth and profitability.

Advantra extracts data from legacy systems to create an always-on eco-system to produce never before seen client insights. Efficient data ingestion and innovative architecture deliver the digital backbone for any modern private bank.

”The ultimate in wealth management, personalisation, transparency and control.”

Advantra delivers unrivalled value and benefits:

Digitises with

minimum investment

Reduces

operating costs

Increases

revenue generation

Focused on

high value

Easy to

implement

Exceptional

user experience

Advantra is a highly evolved, yet simple, personalised and intuitive digital platform. An eco-system that empowers the banks and their clients.

Get the bank’s investment view for key market events, customised to client‘s portfolio

See how Advantra changes the game for:

Advantra gives me access to a fully customised investment channel with a clear view of my portfolio and market events, in a language that I understand.

I get clear investment ideas that fit perfectly with my interests and risk profile. I can choose to discuss them with my banker, or a network of peer investors. The ideas are clear and I understand upside, risks and the fees.

I can chat or video conference my bank instantly on a range of topics 24/7.

The reporting is clear and it shows the impact of my decisions.

CLIENTS

Advantra gives me access to a fully customised investment channel with a clear view of my portfolio and market events, in a language that I understand.

I get clear investment ideas that fit perfectly with my interests and risk profile. I can choose to discuss them with my banker, or a network of peer investors. The ideas are clear and I understand upside, risks and the fees.

I can chat or video conference my bank instantly on a range of topics 24/7.

The reporting is clear and it shows the impact of my decisions.

RELATIONSHIP

MANAGERS

Advantra gives me access to a client portal that shows me their portfolio performance, their interests, decisions they made, risk profile and investment knowledge.

I understand what makes my client tick and what I should talk to them about. I get prompted on investment ideas that are likely to be of interest to my clients

I can offer my clients full access to a self serve platform that allows them to solve their enquiries 24/7, so my meetings with them are strategic and high value.

I can measure the profitability of each client and I can see whether or not the client has the right service package / is paying the right fees.

INVESTMENT

ADVISORS

Advantra’s investment process is mostly automated, this means I can focus on advising my clients on bespoke solutions that deliver suitable returns.

I have access to an automated tool that calculates the most efficient portfolio and re-balancing opportunities based on client insights and risk profiles.

Predictive analysis allows me to put the best investment ideas forward that will get traction across our core client segments

C-SUITE

EXECUTIVES

Advantra allows me to see the profitability of clients at an individual and segment level so I can act on the opportunities decisively.

Advantra’s unique reporting enables me to assess which teams perform, and which investment ideas get traction and why. I also see what drives asset and margin growth.

I implemented a constantly evolving technology solution that allows me to take costs out, and be on top of digital innovation.

I can innovate on pricing, user experience, drive more efficiencies and retain and grow my asset base better and faster than the competition.

“It’s plugging in the most advanced, intuitive, human, transparent and growth focused wealth management solution in the world.”

Advantra goes beyond typical risk profiling to fully understand the client using innovative user experience, cutting edge technology and behavioural cognitive science.

Clients' behaviour when interacting with the platform will continuously enrich their profile and further personalise their banking experience.

Clients receive an automated portfolio that matches their risk budget, returns objectives and preferences.

Advanced algorithms monitor in real time client risk, preferences and market dynamics.

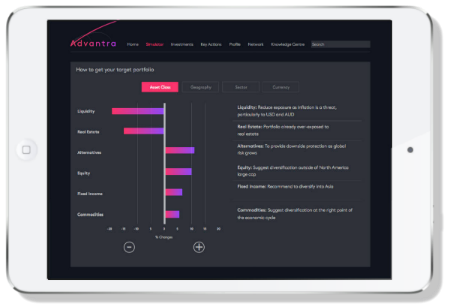

Advantra calculates most efficient rebalancing opportunities at mandate level based on client profiling and it provides ongoing portfolio gap analysis between target portfolio and current state.

Clients get a personalised roadmap to target returns explained in a way that they can understand.

Roadmap to target returns is based on wealth manager's house investment view, market moves and client profile. The explanation of the proposed solutions is fully personalised and adapted to client's financial literacy.

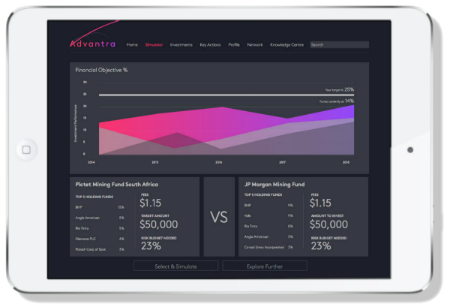

Advantra triggers proposed investment ideas matching client's profile, wealth manager's house investment view and client's available risk budget. All ideas are pre-screened and get validated by the advisor before clients can access them.

Advisors and clients can simulate in real time the impact of any fund or instrument on the investment portfolio.

For example: “You have become over exposed to Apple or US tech stock, your portfolio will be rebalanced accordingly.”

“We have noticed your social interest in artificial intelligence and suggest that these investments may be of interest.”

”This is how you rank compared to other investors with similar portfolios and profiles.”

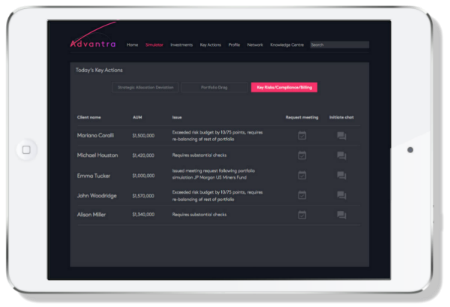

For example: “Client has exceeded their risk budget and the portfolio requires re-balancing.“

“Client has a portfolio drag caused by Investment A, here is the proposed roadmap to optimise their portfolio.“

Fully customisable advisor portal automatically generating a prioritised view of clients and the actions required for the day.

Richer client segmentation and reporting will help each wealth manager understand their cost and revenue drivers.

Predictive analysis and trends on investment behaviour, decision making, engagement model, ROA and efficiency drivers will shape wealth manager’s strategy.

“Advantra will be the digital backbone of the private bank of the future”

Executive Team & Founders

Anka Mandleson

Former Associate Principal at McKinsey&Company with 15 years of banking experience. Anka has worked with UBS, Credit Suisse, Julius Baer, HSBC, Barclays, Bank of America in US, UK, Switzerland, Germany, Spain, Asia and Latin America.

Digitisation, market strategy, M&A and post merger integration, cost savings and restructure and front to back bank transformation.

Aaron Scott

Patrizia Head of Sustainable Transformation, previously UBS Head of Strategy and Product Specialist and Performance Analyst at National Australia Bank. 15 years of corporate, asset and wealth management experience across US, UK, Switzerland, Australia and India.

Strategy, investments, product development, talent management, performance measurement, finance, legal and risk.

Technology Partner & Advisory Board

Retro Rabbit are digital product experts with over 15 years in software engineering, design thinking, and data science. Having worked in every sphere from NGOs to FinTech, at every end of the digital lifecycle, Retro Rabbit has a wealth of experience. They have a reputation for high quality innovative software with a focus on delivery. Originating out of South Africa, they've begun expanding across Africa and Europe.

Ortec Finance is the leading provider of technology and solutions for risk and return management. It is our purpose to enable people to manage the complexity of investment decisions. We do this through delivering leading technologies and solutions for investment decision-making to financial institutions around the world. Our strength lies in an effective combination of advanced models, innovative technology and in-depth market knowledge. This combination of skills and expertise supports investment professionals in achieving a better risk-return ratio and thus better results.

Philip Wels

Philip is the transaction venture partner at Advantra Wealth. He is the founder of Sparkner, a sales and corporate development boutique in Switzerland combining technology and corporate development in various industries. Before this, he worked at KPMG for 5 years in the financial services department as sales and business development manager.

B2B sales, business development, corporate development, sales strategy and support, transaction support.

Martin Stypinski

Martin is the technology venture partner at Advantra Wealth. He is the owner of VeeMG and program director of machine learning for software developers at OST (Eastern Switzerland University of Applied Sciences). He has 10 years experience in software development in various industries, including military.

IT development, machine learning model development, machine learning operations, image processing, IT implementation, migration and project management.